New Zealand’s Troubled Housing Market: A Downswing with Uncertain Prospects

-

By Hadar 11th Jul, 2023

Step into the remarkable world of New Zealand, a country grappling with one of the most challenging housing markets worldwide. Over the past 18 months, the nation’s homeowners and investors have witnessed the erosion of billions of dollars in wealth due to a sharp decline in housing prices triggered by soaring mortgage rates during the Covid pandemic.

Historically, property in New Zealand has always been expensive and scarce. However, the current situation has exacerbated the crisis, as a combination of exorbitant prices, inadequately constructed housing, and the harsh consequences of interest rate hikes has propelled the housing issue to the forefront of national attention, taking precedence even over the upcoming elections.

The downward trend in property prices in New Zealand continues unabated, with an accelerated fall observed in June.

During the pandemic, with the availability of low mortgage rates and relaxed lending regulations, house prices skyrocketed by almost 50 percent. However, since November 2021, when New Zealand’s central bank adopted a hawkish stance to combat rising inflation and initiated one of the most aggressive rate-tightening cycles globally, prices have plummeted by 17.5 percent. This substantial decline has wiped out over $6 billion in household wealth, according to estimates.

The impact of the crisis is evident in the record low number of home sales during the three months leading up to December. Currently, houses remain on the market for an average of 47 days, with some properties languishing for several months, creating a situation of prolonged stagnation.

The urgency for government intervention to address the housing shortage grew in February, when once-in-a-generation storms and flooding wreaked havoc, causing significant damage to thousands of homes on the North Island, rendering some beyond repair. Additionally, in May, tragedy struck when a devastating fire broke out in a hostel in Wellington, the capital, which primarily housed men without stable accommodation, resulting in the loss of five lives.

Despite the relatively low wages and abundant land in New Zealand, which is spread over an area the size of Colorado with a population of five million, the scarcity of construction combined with low borrowing costs meant that buyers had long been forced to pay exorbitant prices for older homes that were poorly built and lacked proper insulation.

The market’s downward trajectory persists, albeit with an element of unpredictability. In June, property values across Aotearoa NZ experienced a further weakening, with the rate of decline accelerating by 1.2%, compared to a 0.7% fall in May.

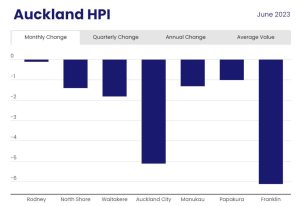

Analyzing CoreLogic’s House Price Index (HPI), it becomes apparent that the decline was led by weaker figures in Auckland, which experienced a 3.0% drop in property values for the month. Four out of the six main centers in New Zealand also recorded larger falls in June.

This decline has resulted in a national annual rate of change that is 10.6% lower compared to the same period last year, down from the 10.2% decline observed in May.

According to the latest CoreLogic Housing Affordability report, servicing an 80% LVR mortgage in New Zealand requires more than 50% of the average household income, in contrast to 43% in Australia.

In June, property values in Auckland experienced a 3% decrease, while the other five main centers saw marginal fluctuations of no more than 0.6%. Christchurch recorded the highest increase during the month at 0.3%, while Tauranga witnessed a 0.1% increase in property values. However, the latter has still seen a decline of 3.4% over the past three months.

The property values in Dunedin appear to have stabilized, with three consecutive months of minimal movement resulting in a quarterly change of -0.4%. Similarly, Christchurch’s property values have remained relatively steady over the past three months, with a decrease of only 0.5%. Annually, Christchurch has experienced a decline of 6.5%, making it the best performing main center in terms of property value retention.

Values in Wellington and Hamilton continue to record modest falls, with Wellington experiencing a decline of 0.6% and Hamilton a decline of 0.2%. However, the rate of change seems to be stabilizing, particularly in Wellington, which has shown a significantly improved rate of change over the three-month period. From June to September of the previous year, Wellington experienced a substantial drop in property values, down by 8.5%. In the most recent three months (April to June), values have only fallen by 1.4%.

Examining the Regional House Price Index, a significant 5.1% fall in Auckland City (and a 6.1% fall in Franklin) stands out. However, caution is advised when interpreting this short-term measure in a volatile market. Auckland City had witnessed a more balanced market in the preceding three months, with relatively stable prices (-0.1%). This trend is also reflected in the smallest annual rate of decline among the Auckland areas (-10.8%).

While it is important to approach a single month’s data with caution, it should not be disregarded. It could indicate an increasing number of sellers accepting lower prices after having their property on the market for an extended period, or it might reflect a change in circumstances. Therefore, it is crucial to closely monitor future sales performance for any signs of increased vendor struggles.

Weakness is observed across the rest of Auckland, with every area recording a decline in property values of more than 3% over the past three months. The Rodney District is the only area that saw minimal change during the month (-0.1%).

The average value of property in Waitakere has fallen below $1 million for the first time since March 2021, currently sitting 19.0% below its peak. This decline is marginally better than Papakura values, which have fallen 19.2% from their peak.

Do You Want To Sell Us Your house?

Request No Obligation Offer!

- New Zealand Housing Market: A Calm December Amidst Economic Uncertainty

- New Zealand Housing Market Update: Downturn Slowing, First Time Buyers on the Rise

- Selling Your Christchurch Home Privately: A Quick Guide

- New Zealand’s Housing Market – Sep 2024 Updates: High Prices and Slow Recovery

- New Zealand Housing Market Slumps in June Amidst Rising Listings and Waning Demand

- Auckland Real Estate Market(26)

- Christchurch Real Estate(38)

- new zealand real estate(32)

- Property(3)

- Sell Your House As-Is(16)

- Uncategorized(1)

- February 2025 (1)

- November 2024 (1)

- October 2024 (1)

- September 2024 (1)

- July 2024 (1)

- June 2024 (2)

- April 2024 (1)

- March 2024 (1)

- February 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- April 2023 (1)

- March 2023 (2)

- February 2023 (2)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- July 2022 (1)

- June 2022 (1)

- April 2022 (1)

- March 2022 (1)

- February 2022 (1)

- January 2022 (1)

- December 2021 (1)

- November 2021 (1)

- October 2021 (1)

- September 2021 (2)

- August 2021 (1)

- July 2021 (2)

- June 2021 (2)

- May 2021 (1)

- April 2021 (1)

- February 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (3)

- August 2020 (2)