New Zealand Housing Market Outlook 2024

-

By Hadar 12th Jan, 2024

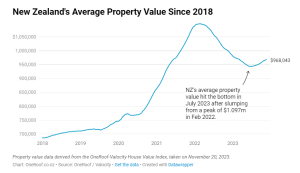

Over the past four years, the housing market has experienced significant fluctuations. Initially, house prices dipped in response to the COVID-19 pandemic but then skyrocketed by 40%. This surge led to the nationwide average property value peaking at $1.09 million in February 2022. However, prices subsequently dropped by 14%, reaching a low of $943,749 in June of the same year.

Since then, the nationwide average property value has slowly increased by almost 3%, gaining momentum in various regions, particularly in major metropolitan areas. The question now arises: What will the housing market’s story be in 2024, and will prices continue to rise? Here are twelve predictions for how the housing market is expected to perform in 2024:

- January – Opinions Abound: Every year, gatherings across New Zealand become a forum for armchair economists to share their property predictions. While these family members may appear confident, it’s important to be cautious about taking their analyses as gospel due to the Dunning-Kruger effect.

- February – Decline in Building Consents: Building consents reached a peak in February 2022, with 4,200 issued that month. Today, monthly consents have dropped to about 3,000, a trend likely to continue as property prices decrease while construction costs rise.

- March – Notable Property Price Rebound: After bottoming out across most of New Zealand, property prices are gradually increasing, ranging from 2% to 4%. By March, the average New Zealander is likely to notice this positive shift in water-cooler conversations.

- April – Lower Taxes for Property Investors: In April, the implementation of National and Act’s reduced property taxes will commence, likely reverting the bright-line test to two years. These policies will contribute to a shift in the market sentiment.

- May – High Interest Rates Continue to Affect Investors: ANZ predicts that interest rates will peak in March 2024. Even by May, interest rates will remain high, causing continued strain on property investors’ cash flow, with most properties still being negatively geared.

- June – National Ends KiwiBuild: National has announced plans to discontinue KiwiBuild and allocate the funds to incentivize councils to approve more properties. Although it may not significantly impact consent numbers in 2024, it could lay the groundwork for a residential construction sector recovery in 2025 and 2026.

- July – Inflation Eases: Inflation currently stands at 5.6%, having peaked at 7.3% last year. By July, inflation is expected to decrease substantially, with banks anticipating rates between 2.5% and 4%.

- August – Rising Rents: With a fast-growing population and migration adding 118,800 people in the past year, rental demand continues to rise. Rents are predicted to increase at a rate higher than 5%.

- September – Introduction of Debt-to-Income Ratios (DTIs): In September, Reserve Bank Governor Adrian Orr may introduce debt-to-income (DTI) ratios, making it more challenging to secure mortgages for existing rental properties. This move further encourages investment in new builds to increase housing supply.

- October – Declining Interest Rates: By the end of the year, interest rates are expected to decrease from their current levels, potentially reaching the low-to-mid sixes by October as wholesale rates trend downward.

- November – Builders Face Bankruptcy: Despite a slow property market in the past year, many developers have had steady income from finished houses sold in 2021. However, this financial cushion may dissipate as builders finish their pipelines, potentially leading to bankruptcies.

- December – Evaluating Predictions: Economists understand that forecasts are rarely entirely accurate. The purpose of making predictions is to gain insight into potential scenarios and prepare for them. By December 2024, we will have a clearer picture of how accurate these predictions were.

Please note that these predictions are based on the available information and should be taken as general observations and forecasts, subject to change as market conditions evolve.

Do You Want To Sell Us Your house?

Request No Obligation Offer!

- New Zealand Housing Market: A Calm December Amidst Economic Uncertainty

- New Zealand Housing Market Update: Downturn Slowing, First Time Buyers on the Rise

- Selling Your Christchurch Home Privately: A Quick Guide

- New Zealand’s Housing Market – Sep 2024 Updates: High Prices and Slow Recovery

- New Zealand Housing Market Slumps in June Amidst Rising Listings and Waning Demand

- Auckland Real Estate Market(26)

- Christchurch Real Estate(38)

- new zealand real estate(32)

- Property(3)

- Sell Your House As-Is(16)

- Uncategorized(1)

- February 2025 (1)

- November 2024 (1)

- October 2024 (1)

- September 2024 (1)

- July 2024 (1)

- June 2024 (2)

- April 2024 (1)

- March 2024 (1)

- February 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- April 2023 (1)

- March 2023 (2)

- February 2023 (2)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- July 2022 (1)

- June 2022 (1)

- April 2022 (1)

- March 2022 (1)

- February 2022 (1)

- January 2022 (1)

- December 2021 (1)

- November 2021 (1)

- October 2021 (1)

- September 2021 (2)

- August 2021 (1)

- July 2021 (2)

- June 2021 (2)

- May 2021 (1)

- April 2021 (1)

- February 2021 (1)

- December 2020 (3)

- November 2020 (1)

- October 2020 (3)

- August 2020 (2)